(b) Assuming that the cost of equity and cost of debt do not alter, estimate the effect of the share repurchase on the company’s cost of capital and value. (5 marks)

题目

(b) Assuming that the cost of equity and cost of debt do not alter, estimate the effect of the share repurchase on the company’s cost of capital and value. (5 marks)

相似考题

更多“(b) Assuming that the cost of equity and cost of debt do not alter, estimate the effect of the share repurchase on the company’s cost of capital and value. (5 marks)”相关问题

-

第1题:

Cost management includes:

A . Cost estimating/forecasting.

B . Cost budgeting/cost control.

C . Cost applications.

D . All of the above.

E . A and B only.

正确答案:D

-

第2题:

18 The difference between the BCWS and the BCWP is referred to as the:

A. Schedule variance

B Cost variance.

C. Estimate of completion

D. Actual cost of the work performed

E. None of the above

正确答案:A

-

第3题:

19 Parametric cost estimating involves

A. using the WBS to do bottom up estimates

B. defining the perimeters of the life-cycle

C. calculating the individual estimates of work packages

D. using a statistical model to estimate costs

E. A and C

正确答案:D

-

第4题:

The method of accounting for investments in equity securities in which the investor records its share of periodic net income of the investee is the ( )A、cost method

B、market method

C、income method

D、equity method

正确答案:D

-

第5题:

(b) The CEO of Oceania National Airways (ONA) has already strongly rejected the re-positioning of ONA as a ‘no

frills’ low-cost budget airline.

(i) Explain the key features of a ‘no frills’ low-cost strategy. (4 marks)

正确答案:

(b) (i) A ‘no frills’ strategy combines low price with low perceived benefits of the product or service. It is primarily associated

with commodity goods and services where customers do not discern or value differences in the products or services

offered by competing suppliers. In some circumstances the customer cannot afford the better quality product or service

of a particular supplier. ‘No frills’ strategies are particularly attractive in price-sensitive markets. Within the airline sector,

the term ‘no frills’ is associated with a low cost pricing strategy. In Europe, at the time of writing, easyJet and Ryanair

are the two dominant ‘no frills’ low-cost budget airlines. In Asia, AirAsia and Tiger Airways are examples of ‘no frills’ lowcost

budget carriers. ‘No frills’ strategies usually exist in markets where buyers have high power coupled with low

switching costs and so there is little brand loyalty. It is also prevalent in markets where there are few providers with

similar market shares. As a result of this the cost structure of each provider is similar and new product and service

initiatives are quickly copied. Finally a ‘no frills’ strategy might be pursued by a company entering the market, using thisas a strategy to gain market share before progressing to alternative strategies. -

第6题:

(b) Identify and discuss the appropriateness of the cost drivers of any TWO expense values in EACH of levels (i)

to (iii) above and ONE value that relates to level (iv).

In addition, suggest a likely cause of the cost driver for any ONE value in EACH of levels (i) to (iii), and

comment on possible benefits from the identification of the cause of each cost driver. (10 marks)

正确答案:

(b) A cost driver is the factor that determines the level of resource required for an activity. This may be illustrated by considering

costs for each of the four levels in Order Number 377.

Unit based costs:

Direct material costs are driven by the quantity, range, quality and price of materials required per product unit according to

the specification for the order.

Direct labour costs are driven by the number of hours required per product unit and the rate per hour that has been agreed

for each labour grade.

Batch related costs:

The number of machine set-ups per batch is the cost driver for machines used.

The number of design hours per batch is the cost driver for design work.

Product sustaining costs:

The number of marketing visits to a client per order is the cost driver for marketing cost chargeable to the order.

The number of hours of production line maintenance per order is the cost driver for production line cost.

Business sustaining costs:

These costs are absorbed at a rate of 30% of total cost excluding business sustaining costs. This is an arbitrary rate which

indicates the difficulty in identifying a suitable cost driver/drivers for the range of residual costs in this category. Wherever

possible efforts should be made to identify aspects of this residual cost that can be added to the unit, batch or product related

analysis.

The cost drivers are useful in that they provide a basis for an accurate allocation of the cost of resources consumed by an

order. In addition, investigation of the cause(s) of a cost driver occurring at its present level allows action to be considered

that will lead to a reduction in the cost per unit of cost driver.

Examples of causes that might be identified are:

Material price may be higher than necessary due to inefficient sourcing of materials. This may be overcome through efforts

to review sourcing policy and possibly provide additional training to staff responsible for the sourcing of materials.

The number of machine set-ups per batch may be due to lack of planning of batch sizes. It may be possible for batch sizes

in this order to be increased to 1,250 units which would reduce the number of batches required to fulfil the order from five

to four. This should reduce overall costs.

The amount of production line maintenance (and hence cost) required per order may be reduced by examining causes such

as level of skill of maintenance carried out – by GMB’s own staff or out-sourced provision. Action would involve re-training of

own staff or recruitment of new staff or changing of out-source providers.

(alternative relevant examples and discussion would be acceptable for all aspects of part (b)) -

第7题:

A financial ______ should be carried out for any potential venture in the manufacturing sector, in order to assess the relationship between production volume, production cost and profits.

A.break-even analysis

B.benefit streams

C.IRR analysis

D.capital cost

正确答案:A

解析:盈亏平衡点分析(break-even analysis)是对成本、产量及利润之间关系的分析。内部收益率(IRR),是使项目的净现值等于零时的折现率。benefit streams收益流。capital cost资本成本。 -

第8题:

KFP Co, a company listed on a major stock market, is looking at its cost of capital as it prepares to make a bid to buy a rival unlisted company, NGN. Both companies are in the same business sector. Financial information on KFP Co and NGN is as follows:

NGN has a cost of equity of 12% per year and has maintained a dividend payout ratio of 45% for several years. The current earnings per share of the company is 80c per share and its earnings have grown at an average rate of 4·5% per year in recent years.

The ex div share price of KFP Co is $4·20 per share and it has an equity beta of 1·2. The 7% bonds of the company are trading on an ex interest basis at $94·74 per $100 bond. The price/earnings ratio of KFP Co is eight times.

The directors of KFP Co believe a cash offer for the shares of NGN would have the best chance of success. It has been suggested that a cash offer could be financed by debt.

Required:

(a) Calculate the weighted average cost of capital of KFP Co on a market value weighted basis. (10 marks)

(b) Calculate the total value of the target company, NGN, using the following valuation methods:

(i) Price/earnings ratio method, using the price/earnings ratio of KFP Co; and

(ii) Dividend growth model. (6 marks)

(c) Discuss the relationship between capital structure and weighted average cost of capital, and comment on

the suggestion that debt could be used to finance a cash offer for NGN. (9 marks)

正确答案:

(b)(i)Price/earningsratiomethodEarningspershareofNGN=80cpersharePrice/earningsratioofKFPCo=8SharepriceofNGN=80x8=640cor$6·40NumberofordinarysharesofNGN=5/0·5=10millionsharesValueofNGN=6·40x10m=$64millionHowever,itcanbearguedthatareductionintheappliedprice/earningsratioisneededasNGNisunlistedandthereforeitssharesaremoredifficulttobuyandsellthanthoseofalistedcompanysuchasKFPCo.Ifwereducetheappliedprice/earningsratioby10%(othersimilarpercentagereductionswouldbeacceptable),itbecomes7·2timesandthevalueofNGNwouldbe(80/100)x7·2x10m=$57·6million(ii)DividendgrowthmodelDividendpershareofNGN=80cx0·45=36cpershareSincethepayoutratiohasbeenmaintainedforseveralyears,recentearningsgrowthisthesameasrecentdividendgrowth,i.e.4·5%.Assumingthatthisdividendgrowthcontinuesinthefuture,thefuturedividendgrowthratewillbe4·5%.Sharepricefromdividendgrowthmodel=(36x1·045)/(0·12–0·045)=502cor$5·02ValueofNGN=5·02x10m=$50·2million(c)Adiscussionofcapitalstructurecouldstartfromrecognisingthatequityismoreexpensivethandebtbecauseoftherelativeriskofthetwosourcesoffinance.Equityisriskierthandebtandsoequityismoreexpensivethandebt.Thisdoesnotdependonthetaxefficiencyofdebt,sincewecanassumethatnotaxesexist.Wecanalsoassumethatasacompanygearsup,itreplacesequitywithdebt.Thismeansthatthecompany’scapitalbaseremainsconstantanditsweightedaveragecostofcapital(WACC)isnotaffectedbyincreasinginvestment.Thetraditionalviewofcapitalstructureassumesanon-linearrelationshipbetweenthecostofequityandfinancialrisk.Asacompanygearsup,thereisinitiallyverylittleincreaseinthecostofequityandtheWACCdecreasesbecausethecostofdebtislessthanthecostofequity.Apointisreached,however,wherethecostofequityrisesataratethatexceedsthereductioneffectofcheaperdebtandtheWACCstartstoincrease.Inthetraditionalview,therefore,aminimumWACCexistsand,asaresult,amaximumvalueofthecompanyarises.ModiglianiandMillerassumedaperfectcapitalmarketandalinearrelationshipbetweenthecostofequityandfinancialrisk.Theyarguedthat,asacompanygearedup,thecostofequityincreasedataratethatexactlycancelledoutthereductioneffectofcheaperdebt.WACCwasthereforeconstantatalllevelsofgearingandnooptimalcapitalstructure,wherethevalueofthecompanywasatamaximum,couldbefound.Itwasarguedthattheno-taxassumptionmadebyModiglianiandMillerwasunrealistic,sinceintherealworldinterestpaymentswereanallowableexpenseincalculatingtaxableprofitandsotheeffectivecostofdebtwasreducedbyitstaxefficiency.Theyrevisedtheirmodeltoincludethistaxeffectandshowedthat,asaresult,theWACCdecreasedinalinearfashionasacompanygearedup.Thevalueofthecompanyincreasedbythevalueofthe‘taxshield’andanoptimalcapitalstructurewouldresultbygearingupasmuchaspossible.Itwaspointedoutthatmarketimperfectionsassociatedwithhighlevelsofgearing,suchasbankruptcyriskandagencycosts,wouldlimittheextenttowhichacompanycouldgearup.Inpractice,therefore,itappearsthatcompaniescanreducetheirWACCbyincreasinggearing,whileavoidingthefinancialdistressthatcanariseathighlevelsofgearing.Ithasfurtherbeensuggestedthatcompanieschoosethesourceoffinancewhich,foronereasonoranother,iseasiestforthemtoaccess(peckingordertheory).Thisresultsinaninitialpreferenceforretainedearnings,followedbyapreferencefordebtbeforeturningtoequity.TheviewsuggeststhatcompaniesmaynotinpracticeseektominimisetheirWACC(andconsequentlymaximisecompanyvalueandshareholderwealth).TurningtothesuggestionthatdebtcouldbeusedtofinanceacashbidforNGN,thecurrentandpostacquisitioncapitalstructuresandtheirrelativegearinglevelsshouldbeconsidered,aswellastheamountofdebtfinancethatwouldbeneeded.Earliercalculationssuggestthatatleast$58mwouldbeneeded,ignoringanypremiumpaidtopersuadetargetcompanyshareholderstoselltheirshares.Thecurrentdebt/equityratioofKFPCois60%(15m/25m).Thedebtofthecompanywouldincreaseby$58minordertofinancethebidandbyafurther$20maftertheacquisition,duetotakingontheexistingdebtofNGN,givingatotalof$93m.Ignoringotherfactors,thegearingwouldincreaseto372%(93m/25m).KFPCowouldneedtoconsiderhowitcouldservicethisdangerouslyhighlevelofgearinganddealwiththesignificantriskofbankruptcythatitmightcreate.ItwouldalsoneedtoconsiderwhetherthebenefitsarisingfromtheacquisitionofNGNwouldcompensateforthesignificantincreaseinfinancialriskandbankruptcyriskresultingfromusingdebtfinance. -

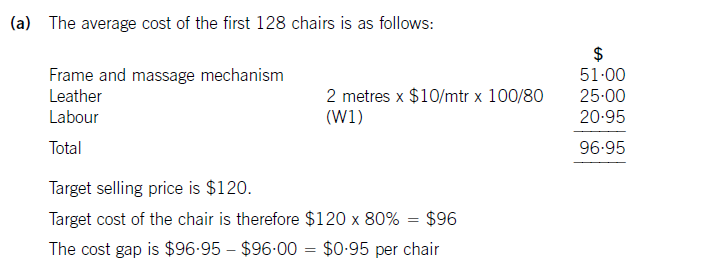

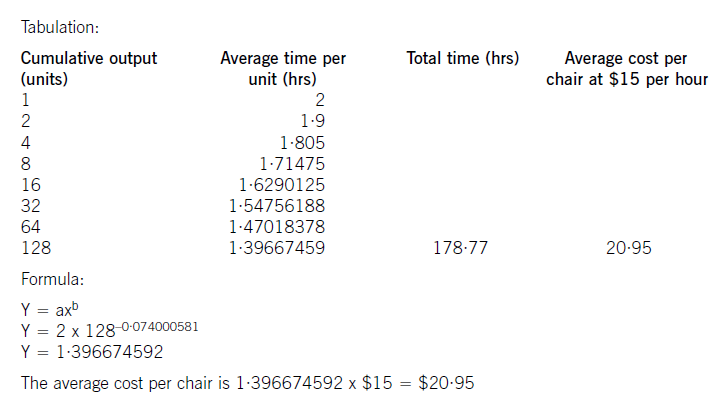

第9题:

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

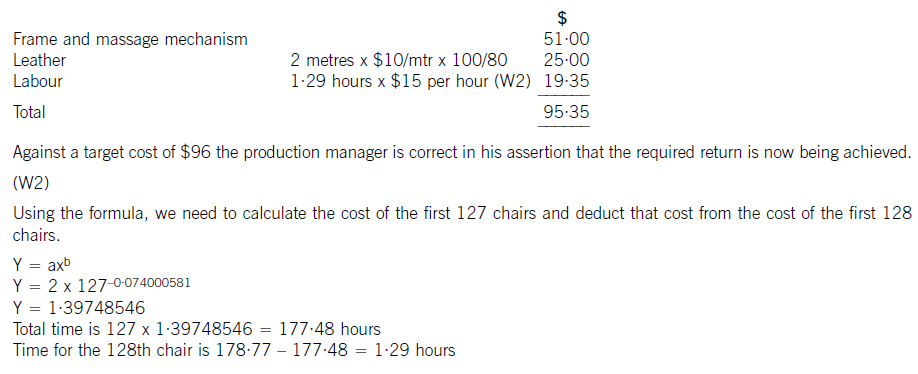

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

正确答案:

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

-

第10题:

The cost performance index(CPI) is the ratio of earned value to ( ) and can be used to estimate the projected cost of completing the project.A.cost variance

B.planned cost

C.Planned value

D.actual cost答案:D解析:翻译:

成本绩效指数是挣值和(73)的比率,用来估算完成整个工程的预计费用。

A. 成本差值 B. 计划成本 C. 计划值 D. 实际花费 -

第11题:

( )is a process of monitoring the status of the project to update the project costs and manage changes to the cost baselineA.Plan Cost Management

B.Estimate Costs

C.Determine Budget

D.Control Costs答案:D解析:控制成本是一个监控项目状态的过程,目的是更新项目成本并且对成本基准的变化进行管理。 -

第12题:

单选题X(s)=(s+1)/[s(s2+2s+2)]的原函数为( )。A1/2+e-t(sint+cost)/2

B1/2+e-t(sint-cost)/2

Ct/2+e-t(sint-cost)/2

D1/2+et(sint-cost)/2

正确答案: D解析:

X(s)=(s+1)/[s(s2+2s+2)]=1/(2s)-(1/2)·(s+1)/[(s+1)2+1]+(1/2)·1/[(s+1)2+1]。对X(s)进行拉氏反变换可得,可得原函数x(t)=1/2+e-t(sint-cost)/2。 -

第13题:

98 Cost management includes:

A. Cost estimating/forecasting.

B. Cost budgeting/cost control.

C. Cost applications.

D. All of the above.

E. A and B only

正确答案:D

-

第14题:

114 The Cost Performance Index is computed as:

A. budget cost of work performed divided by actual cost of work performed

B. budget cost of work performed minus actual cost of work performed

C. budget cost of work performed minus budget cost of work scheduled

D. budget cost of work scheduled divided by budget cost of work performed

E. actual cost of work scheduled divided by budget cost of work performed

正确答案:A

-

第15题:

44 The estimated cost to complete (ETC) is _____.

A. BCWP/ACWP

B. the forecasted and final cost - cost to date

C. (ACWP-BCWP)/BCWP * 100

D. Total estimate - ACWP

E. None of the above

正确答案:B

-

第16题:

(d) Calculate the ex dividend share price predicted by the dividend growth model and discuss the company’s

view that share price growth of at least 8% per year would result from expanding into the retail camera

market. Assume a cost of equity capital of 11% per year. (6 marks)

正确答案:

(d) The dividend growth model calculates the ex div share price from knowledge of the cost of equity capital, the expected growth

rate in dividends and the current dividend per share (or next year’s dividend per share). Using the formula given in the

formulae sheet, the dividend growth rate expected by the company of 8% per year and the decreased dividend of 7·5p per

share:

Share price = (7·5 x 1·08)/(0·11 – 0·08) = 270p or £2·70

This is the same as the share price prior to the announcement (£2·70) and so if dividend growth of 8% per year is achieved,

the dividend growth model forecasts zero share price growth. The share price growth claim made by the company regarding

expansion into the retail camera market cannot therefore be substantiated.

In fact, a lower future share price of £2·49 was predicted by applying the current price-earnings ratio to the earnings per

share resulting from the proposed expansion. If this estimate is correct, a fall in share price of 7% can be expected.

The share price predicted by the dividend growth model of £2·70 would require an after-tax return on the proposed expansion

of 11·66%, which is more than the 9% predicted by the Board. The current return on shareholders’ funds is 7·5% (4·5/60),

but in 2005 it was 12·8% (7·3/57), so 11·66% may be achievable, but looks unlikely.

Since the market price fell from £2·70 to £2·45 following the announcement, it appears that the market does not believe

that the forecast dividend growth can be achieved. -

第17题:

4 (a) A company may choose to finance its activities mainly by equity capital, with low borrowings (low gearing) or by

relying on high borrowings with relatively low equity capital (high gearing).

Required:

Explain why a highly geared company is generally more risky from an investor’s point of view than a company

with low gearing. (3 marks)

正确答案:

(a) A highly-geared company has an obligation to pay interest on its loans regardless of its profit level. It will show high profits if

its overall rate of return on capital is greater than the rate of interest being paid on its borrowings, but a low profit or a loss if

there is a down-turn in its profit such that the rate of interest to be paid exceeds the return on its assets. -

第18题:

(c) Discuss the practical problems that may be encountered in the implementation of an activity-based system

of product cost management. (5 marks)

正确答案:

(c) The benefits of an activity-based system as the basis for product cost/profit estimation may not be straightforward. A number

of problems may be identified.

The selection of relevant activities and cost drivers may be complicated where there are many activities and cost drivers in

complex business situations.

There may be difficulty in the collection of data to enable accurate cost driver rates to be calculated. This is also likely to

require an extensive data collection and analysis system.

The problem of ‘cost driver denominator level’ may also prove difficult. This is similar to the problem in a traditional volume

related system. This is linked to the problem of fixed/variable cost analysis. For example the cost per batch may be fixed. Its

impact may be reduced, however, where the batch size can be increased without a proportionate increase in cost.

The achievement of the required level of management skill and commitment to change may also detract from the

implementation of the new system. Management may feel that the activity based approach contains too many assumptions

and estimates about activities and cost drivers. There may be doubt as to the degree of increased accuracy which it provides.

(alternative relevant examples and discussion would be acceptable) -

第19题:

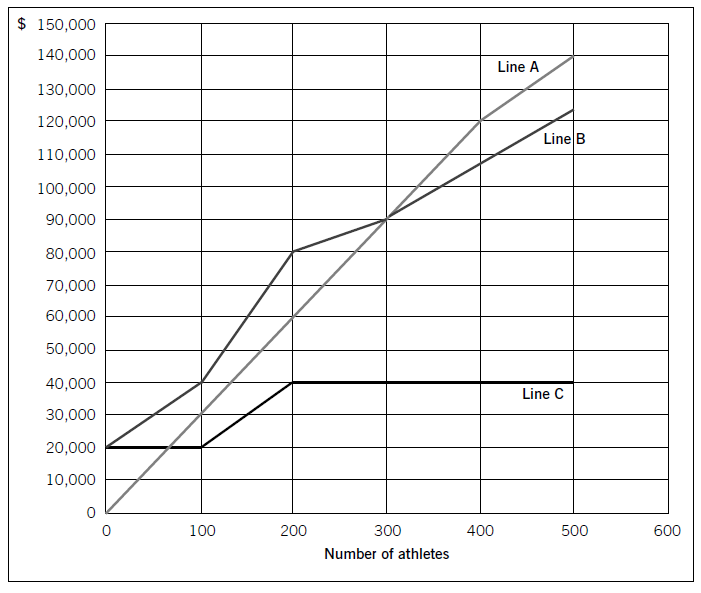

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

正确答案:

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1 -

第20题:

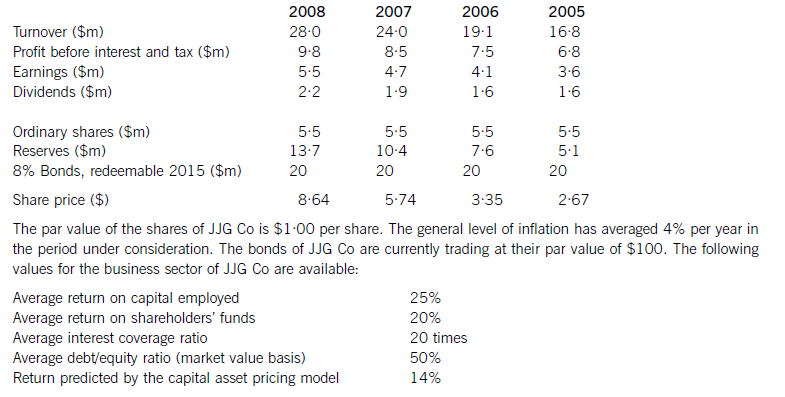

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第21题:

The cost performance index(CPI) is the ratio of earned value to () and can be used to estimate the projected cost of completing the project.

A.cost variance

B.planned cost

C.planned cost

D.actual cost

正确答案:D

-

第22题:

The cost performance index(CPI) is the ratio of earned value to ( ) and can be used to estimate the projected cost of completing the project.A. cost variance

B.planneD.cost

C.PlanneD.value

D.actual cost答案:D解析:翻译:

成本绩效指数是挣值和( )的比率,用来估算完成整个工程的预计费用。

A. 成本差值 B. 计划成本 C. 计划值 D. 实际花费 -

第23题:

Pipelines are not ()

- A、labor-intensive

- B、capital-intensive

- C、tech-intensive

- D、low cost and high return

正确答案:A